Unveiling the Possibility: Can People Discharged From Bankruptcy Acquire Credit Rating Cards?

Recognizing the Impact of Bankruptcy

Upon declaring for personal bankruptcy, people are challenged with the considerable consequences that permeate numerous elements of their economic lives. Insolvency can have a profound influence on one's credit history, making it challenging to accessibility credit history or finances in the future. This monetary tarnish can remain on debt records for several years, affecting the person's capability to safeguard beneficial rate of interest or financial possibilities. Furthermore, bankruptcy might result in the loss of assets, as specific ownerships may require to be liquidated to settle lenders. The emotional toll of personal bankruptcy ought to not be underestimated, as people might experience feelings of shame, guilt, and stress and anxiety as a result of their economic scenario.

In addition, personal bankruptcy can restrict employment possibility, as some companies conduct credit score checks as part of the employing procedure. This can position a barrier to individuals seeking brand-new job prospects or profession innovations. On the whole, the influence of bankruptcy extends beyond monetary restraints, influencing various elements of an individual's life.

Variables Affecting Charge Card Approval

Complying with personal bankruptcy, people frequently have a reduced credit rating score due to the unfavorable effect of the personal bankruptcy declaring. Credit scores card business normally look for a credit rating that demonstrates the applicant's capacity to take care of debt properly. By meticulously thinking about these factors and taking steps to restore debt post-bankruptcy, people can enhance their prospects of acquiring a credit history card and working towards economic healing.

Actions to Reconstruct Credit History After Bankruptcy

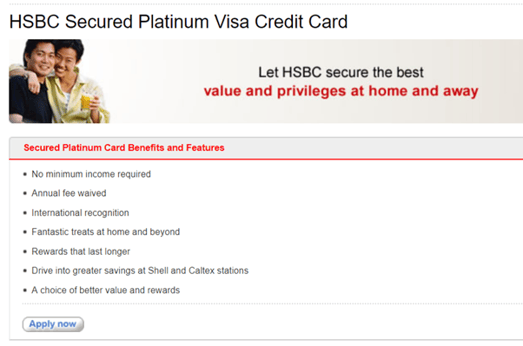

Restoring credit rating after personal bankruptcy calls for a strategic approach concentrated on economic technique and regular debt management. One effective strategy is to acquire a protected debt card, where you deposit a specific amount as collateral to establish a credit scores limitation. Furthermore, take into consideration coming to be an authorized user on a household member's credit scores card or checking out credit-builder fundings to additional increase your credit rating rating.

Protected Vs. Unsecured Credit Report Cards

Complying with personal bankruptcy, people commonly think about the selection between secured and unprotected credit scores cards as they aim to reconstruct their credit reliability and monetary security. Guaranteed credit report cards call for a cash down payment that offers as collateral, normally equivalent to the credit scores limitation given. check this site out Inevitably, the option between secured and unsafe credit rating cards ought to line up with the person's monetary purposes and capability to manage credit history responsibly.

Resources for People Looking For Credit Score Rebuilding

For individuals intending to improve their creditworthiness post-bankruptcy, discovering offered sources is essential to efficiently navigating the credit history rebuilding procedure. secured credit card singapore. One important resource for individuals seeking credit report rebuilding is credit rating counseling firms. These organizations provide economic education, budgeting aid, and customized credit renovation plans. By functioning with a credit therapist, people can acquire understandings right into their debt reports, find out techniques to boost their debt ratings, and get advice on managing their finances effectively.

An additional practical resource is credit report tracking services. These services permit people to keep go a close eye on their credit history records, track any kind of errors or changes, and find potential indications of identification burglary. By monitoring their credit score regularly, individuals can proactively address any kind of issues that might make sure and occur that their credit history information is up to day and exact.

Moreover, online tools and resources such as credit history simulators, budgeting apps, and financial proficiency sites can provide individuals with beneficial information and tools to assist them in their credit scores reconstructing journey. secured credit card singapore. By leveraging these sources properly, individuals released from bankruptcy can take significant actions towards boosting their credit rating health and wellness and safeguarding a much better financial future

Conclusion

To conclude, individuals released from personal bankruptcy may have the opportunity to acquire charge card by taking steps to reconstruct their credit rating. Elements such as credit score debt-to-income, background, and revenue proportion play a substantial function in charge card approval. By comprehending the impact of bankruptcy, choosing between protected and unsecured credit scores cards, and using resources for credit report rebuilding, people can boost their credit reliability and possibly obtain access to bank card.

By functioning with a credit navigate to this site score therapist, individuals can acquire insights right into their credit score reports, find out approaches to increase their debt scores, and obtain guidance on handling their financial resources effectively. - secured credit card singapore

Comments on “A Thorough Review of Secured Credit Card Singapore Options for Boosted Credit Scores Control”